Total Cost of Credit vs. APR

Often when we talk about reporting the “true cost” of loans we are asked why it isn’t enough to simply tell borrowers the “total cost” of their loan—in other words, the total amount of interest they will pay over the life of the loan. At first glance this can seem like an obvious solution, but in reality it’s a deceptive way of thinking about loan price.

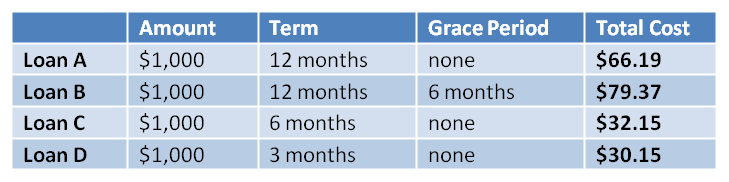

To see why, consider the following loans, all for the same amount:

A client might think that because these loans are all for the same amount ($1,000), we can just look at the “Total Cost” to see which is cheapest. If we only consider the total cost of credit, loans C and D seem like they are significantly cheaper than loans A and B. However, this is a trap. While it is true that clients who take out loans A and B will end up paying more in interest, “total cost” does nothing to account for the period over which they are repaying the loan.

When a client is given a loan, the benefit they derive from the loan is related not only to the amount of money they have taken out, but also the amount of time they will be able to use this money before repayment. This makes sense, as the longer they have the money, the longer they can put it to work to better their business or household. So a good pricing mechanism must take into account both loan amount and the time period over which they have use of this loan money. For this we need the Annual Percentage Rate (APR), as APR takes into account the time value of money.

To see the difference time makes, look at the APRs for these same loans:

As you can see APR gives us a very different result than total cost of credit. Loan D has the lowest cost of credit but the highest APR! This is because for loan D the $1000 loan amount and the $30.15 in interest are paid back in 3 months (as opposed to 6 or 12 months for the other loans), thus the borrower only has 3 months to use the loan money.

To put this in more tangible terms:

When you take out a loan you are essentially “renting” money. You are given money that is owned by someone else and you agree to pay them “rent” (interest) for this privilege. This is just like renting anything else, an apartment for example. If you rent an apartment, a room that costs $1000 dollars per day is very different than a room that costs $1000 dollars per month. Using Total Cost of Credit is like looking at the price of an apartment, but not taking into account how long you will be able to stay!

But APR is like looking at a standardized cost per year for that same apartment:

- $1,000 per day = $365,000 per year

- $1,000 per month = $12,000 per year

Even an inexperienced customer can appreciate the difference. When price is standardized, the decision is simple!

Thus the problem with using Total Cost of Credit is that it does not incorporate the time value of money. A small cost in a short time can be much harder to pay back that a larger cost over a longer time. It’s not only how much you pay back, but when you pay it back. The price must account for how long can you put that loan to work to make a return that will pay for the interest. APR is thus a better indicator of price as it takes into account both time and money!

Dear sir,

I think this is the most powerful tool easily understand small MFI and Community based CB-MFI organisation Explanatory to Members.Kindly send the more dtails

Thanks,

with regards,

VINI Financial and management consultants Pvt Limited.(NBFC-MFI)

Sangamam Women’s multi purpose Thrift and Credit

Co-operative Society Limited.

16 years of experience in Development and Micro financial services, focusing on sales, distribution, propositions,Micro finance Operations & Product Development to manage operational activities to the field level including credit, Risk, Micro Health insurance and transformational activities.